Grow Without Building: Labs Embrace Smarter, Scalable Upgrades

Key findings from the 2025 US Life Sciences Property Report. Image: Courtesy of JLL

The US life sciences real estate sector is in a complex moment. According to JLL’s 2025 US Life Sciences Property Report, leasing volume has slowed considerably in early 2025 following a modest rebound last year. Yet, despite the dip in demand, the sector may be on the cusp of a transformation—not through new construction or sweeping redevelopment, but through targeted investments in biomanufacturing and smart, low-cost upgrades to existing space.

JLL’s research shows that 15 large-cap global pharmaceutical companies have announced more than $270 billion in US-based biomanufacturing and R&D investments since the start of the year. The reshoring trend, sparked by tariff threats, data security concerns, and the broader push for supply chain resilience, has already led to a 185 percent spike in demand for biomanufacturing space across key US markets in the past six months.

For many companies, the current real estate strategy is not expansion—it’s optimization. Long-term leases are rare, relocations are down, and in-place renewals are at an all-time high. As tenant retention rises and speculative development plummets, lab users and operators alike are shifting their focus to doing more with what they already have.

Pam Paddock, managing director, life sciences at JLL, sees this moment as an opportunity to rethink lab layout and utilization without overhauling infrastructure. “Some of the most impactful and least disruptive or costly improvements to space can be made by reviewing and adjusting turning radii, corridors, and paths of travel,” she says. “Ask yourself these questions: ‘Does this need to be here? Where do I use this? Can I get to what I need quickly without disruption to my work or that of others?’”

That mindset—centered on user experience, workflow optimization, and future flexibility—is becoming increasingly essential as companies pivot to shorter lease terms and evolving scientific workflows.

Regional gaps widen, but optimization opportunities multiply

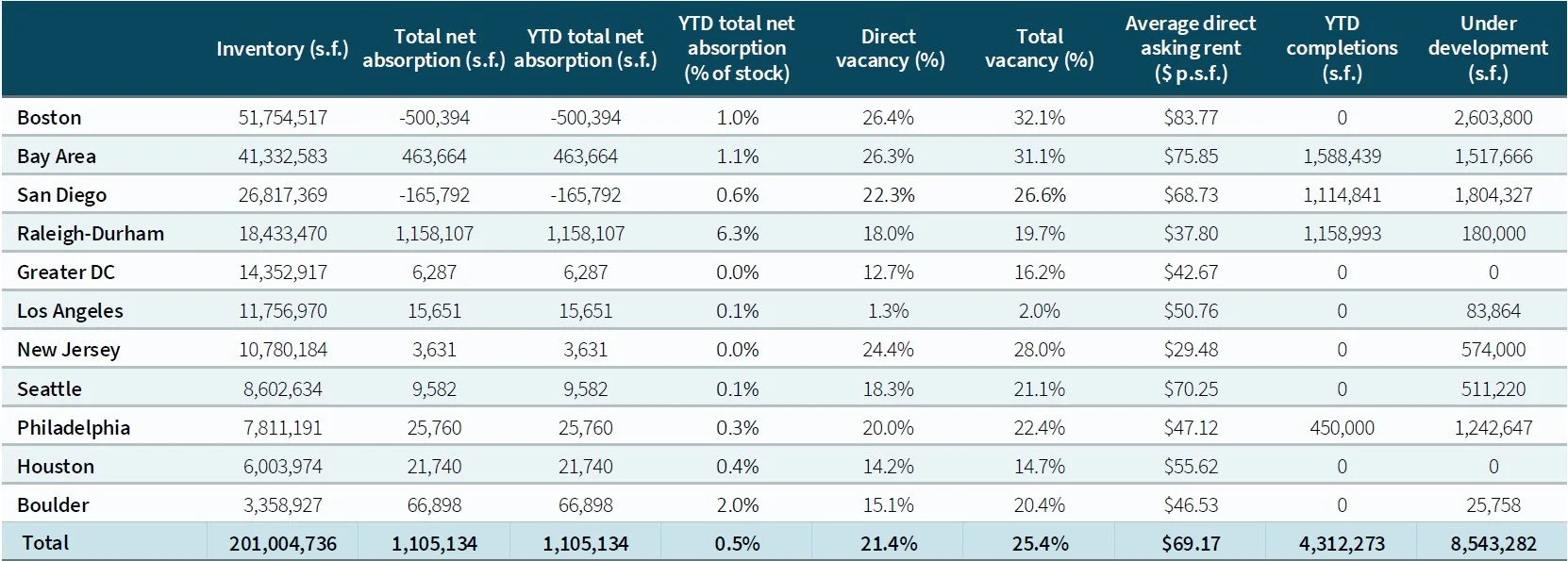

While the national lab market faces oversupply—currently totaling about 200 million square feet—performance varies by region. Markets like Boston, San Diego, and the San Francisco Bay Area are grappling with high vacancy and downward rent pressure. Others, including Raleigh-Durham, New Jersey, and Greater Washington, DC, show more balanced dynamics. Los Angeles stands out for its tight availability and rent growth.

Life sciences real estate markets in the US. Image: Courtesy of JLL

Across all geographies, however, tenants are consistently seeking high-quality Class A space in top-tier submarkets. Still, many are now asking how to bring a Class A experience to existing space on a tighter budget.

According to Paddock, some of the smartest solutions are also the simplest. “Focus on assuring that your ‘must haves’ are well-maintained and in good order and located where they need to be,” she advises. “It’s critical to keep safety as a top priority: fume hoods, eye washing stations, safety showers, fire extinguishers, etc. Be sure they are in the right places, marked and regularly maintained.”

Other low-cost interventions include better cable management, improved lighting, and creating central storage hubs or shared instrument areas to reduce cross-traffic and bottlenecks. “Lab support services can get materials where they need to be when they need to be there,” Paddock notesd. “This puts more in-lab time in the hands of your very valuable researchers.”

Preparing for the biomanufacturing pivot

Los Angeles stands out with rent growth driven by limited availability, while major hubs like Boston, the Bay Area, and San Diego face high vacancies and falling rents. Image: Courtesy of JLL

With biomanufacturing on the rise, companies that aren’t yet ready to build may still want to prepare their space for future shifts. Paddock suggests being “meticulous in the planning of utility connections and the space required to accommodate modular benchtops and storage,” which allows for smoother transitions later.

Likewise, companies rethinking internal workflows or consolidating teams should evaluate what work must happen inside the lab versus what can move to adjacent office or touchdown space. “To the extent possible, consider modular bench components, move non-essential workspace outside, but near the lab to improve space utilization,” she says. “Conserve your lab space for true laboratory needs.”

Amenitizing the experience

From a landlord’s perspective, tenant retention is the name of the game—and much of that comes down to experience. “Researchers, like all workers, are energized by attractive spaces that accommodate their needs inside and outside the lab,” says Paddock. “Amenities programs and employee experience initiatives help retain tenants and their talent.”

Flexible seating, collaborative zones, and lounge-style break areas can boost morale and performance—without expensive construction. Touring other labs within an organization and reviewing storage catalogues are also simple ways to generate new ideas for maximizing underutilized areas like corridors or corners.

As JLL’s report makes clear, speculative lab development is slowing significantly, with only 8.5 million square feet currently under construction—a 69 percent drop from Q1 2024. For the foreseeable future, the life sciences sector will be defined not by how much is built, but by how intelligently existing space is used.

As Paddock puts it, “Labs can prepare for growth while keeping costs in mind by being future ready with a focus on being scalable and agile.” For many companies navigating today’s uncertainty, that starts with knowing the difference between the “nice to haves” and the “must haves”—and investing accordingly.